When the time comes to rent out your property, it is critically important to know the credit scores of your applicants. Why? Because having knowledge of your applicants’ credit history and how that history is calculated is crucial in selecting a reliable and responsible tenant.

But, according to a recent study by TransUnion Interactive Inc., nearly three-quarters of Americans do not understand how credit scoring works or that there are many credit scoring models out there.

When asked to indicate their understanding of the different credit scoring models available, 26.9 percent of survey respondents said they have “little to no understanding” and 39.2 percent said they have only partial understanding of scoring models. Only 16 percent of those surveyed reported a “great” understanding of the different scoring models.

“Many landlords rely on credit scores as a predictor of a tenant’s reliability and likelihood of paying rent on-time,” notes Mike Doherty, senior vice president of TransUnion’s rental screening solutions group. “Tenants with a lower credit score are less likely to be approved by landlords, which is why it’s so important for landlords to know how the different scoring models are calculated.”

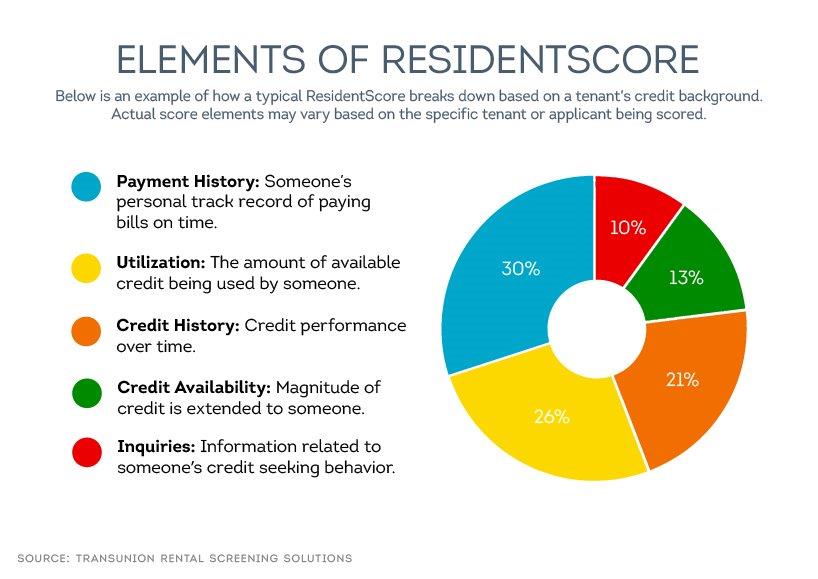

Scoring models are based on different complex algorithms. As a result, even if each of the three national bureau credit reports contain the same information, the score may vary based on the scoring model used. Knowing the difference between the scoring models can help landlords be better prepared to interpret whether the score is “good” or “bad.”

Consumers have control over several factors and behaviors that contribute to their credit score. Here’s how to work towards healthier credit:

- Payment history. A solid record of on-time payments helps your credit score.

- Outstanding debt. High balances in relation to your credit limits can lower your credit score. Aim for balances under 35 percent.

- Credit account history. An established credit history makes you a more attractive prospect to landlords. Think carefully before closing old accounts before a loan application.

- Hard inquiries. When a lender or business checks your credit, it causes a “hard inquiry” that can negatively impact the overall score. Rental applicants who use SmartMove can push their credit score to the landlord, resulting in a “soft inquiry” which doesn't impact their credit scores.

TransUnion SmartMove is a convenient and secure way for landlords and their potential renters to complete a tenant credit and background search. SmartMove provides landlords with a leasing recommendation† as well as access to a tenant’s credit report and national criminal record result. And it gives renters a more secure way to authorize access to their credit and criminal history because there’s no need to provide landlords with personal identifying information such as social security and account numbers.

†The SmartMove recommendation service (a credit score based recommendation) may not be available in certain jurisdictions, and is subject to laws that may limit or otherwise prohibit your use in certain jurisdictions, including but not limited to Washington D.C.