One of the most crucial steps in finding a great tenant, is to do a complete tenant screening. Fully screening your applicant will give you a well-rounded view of their background and allow you to assess possible risks you’d be taking by renting to them.

Your full tenant screening should include both a credit and eviction report, as well as a criminal background check. Each of these reports can be obtained on their own, but as a busy landlord, it’s difficult to find the time and the resources to access all of the reports that you need.

SmartMove combines the powerful data and analytics of TransUnion to provide you with a quick and reliable tenant screening service. You get all the information you need to make more informed screening decisions in less time, including a leasing recommendation† tailored to your particular property. You’ll be able to make better decisions for your rental property online within minutes.

Here are the top 11 benefits of using TransUnion SmartMove to screen potential tenants:

1.Better predict evictions:

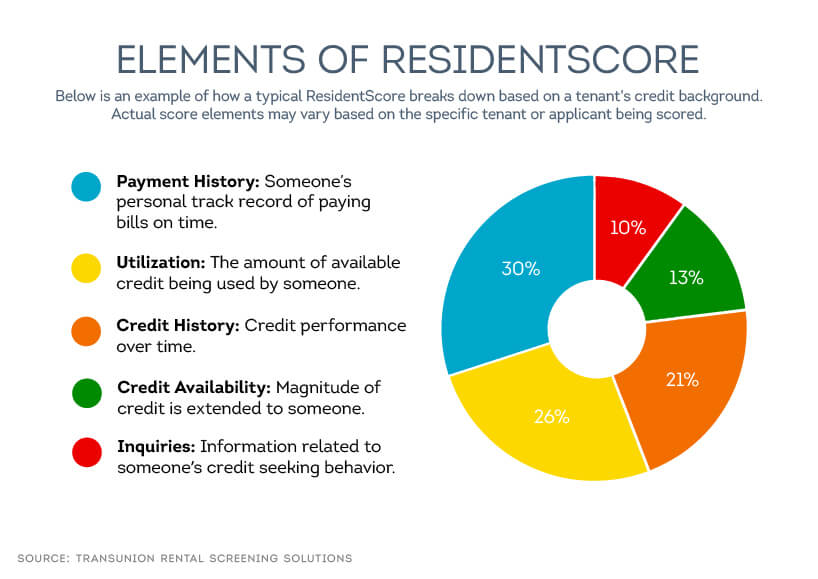

On average, it costs $2,500 - $3,500* to evict a tenant. Most landlords want to avoid this at all costs. Luckily, SmartMove’s using the powerful data and analytics of TransUnion, SmartMove’s ResidentScore is specifically designed to predict the likelihood of a bad outcome on a lease. TransUnion has collected rental outcomes of over 1.5 million individuals across the nation and has identified the pieces of credit data that are most indicative of evictions. This means that ResidentScore is tailored to the unique needs of landlords.

When you use ResidentScore, you get results that will help you better protect your rental property income.

2. Start screening right away:

SmartMove is a great option for small landlords since the process does not require a lengthy enrollment process or on-site inspection. All you need is the renter’s email address to start screening, and the results are received within minutes.

3. Receive full credit, criminal, and eviction reports:

In a 2016 SmartMove user survey, 60% of respondents strongly or somewhat agreed that criminal history is more important than an applicant’s credit history. Receiving full credit, criminal, and eviction reports provide a more complete view of your applicant’s background than a simple check of their financial history. Using advanced filters and industry best practices to provide superior coverage, a SmartMove tenant background check searches:

- 200+ million criminal records from both state and national databases

- 25+ million eviction records

- 500+ million credit histories

4. Compliant process:

As a landlord, you must abide by federal and state regulations in your dealings with applicants and tenants. SmartMove data is regulated by the Fair Credit Reporting Act (FCRA)and is designed to be compliant with the FCRA and similar state laws, where applicable.

5. Easy online process:

These days, both landlords and tenants live their lives on the go. SmartMove allows you to screen applicants at your own convenience, and you can view the results on your computer, phone, or tablet. You can even have an applicant fill out SmartMove’s screening application on their mobile device at a property showing for even faster results.

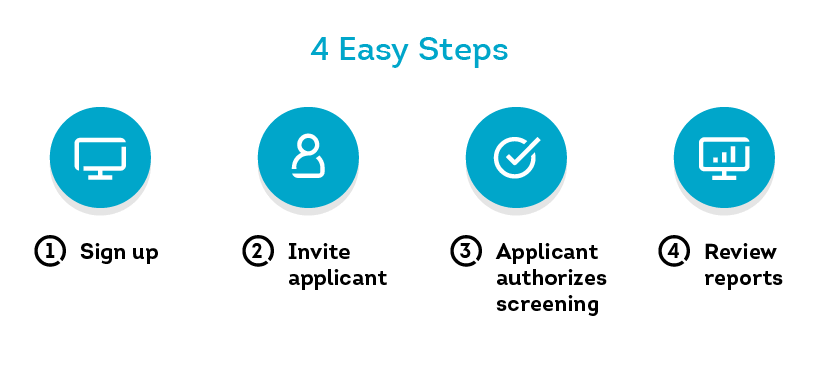

SmartMove’s online process works in four easy steps:

- Set up a free account.

- Email a screening request to the applicant.

- The applicant authorizes screening by providing personal information.

- Once the applicant successfully verifies their identity, the reports and leasing recommendation† are emailed directly to the landlord.

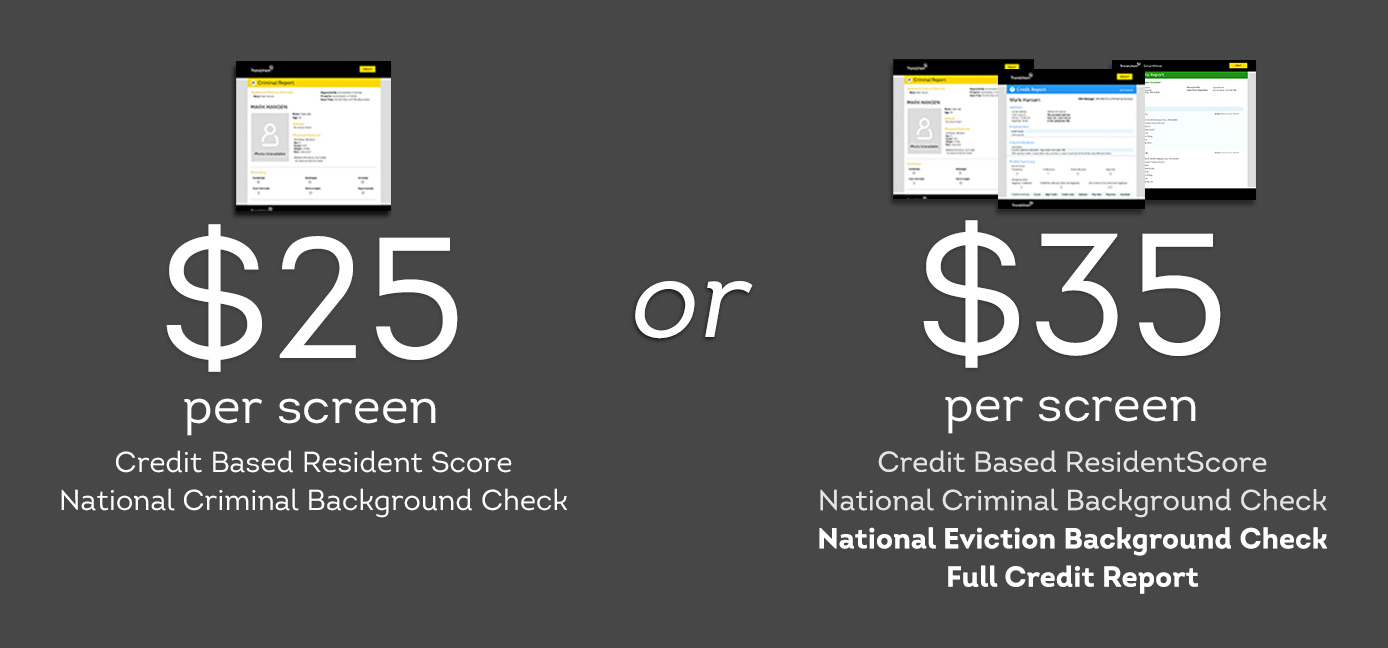

6. Straightforward payment:

With SmartMove, you create an account for free and there’s no charge until you use it. You don’t have to worry about hidden fees, minimums, or memberships. SmartMove also offers maximum flexibility. As a landlord, you choose to pay for the service or pass along the fee to the applicant.

With two easy pricing options, you simply choose the option that works best for you:

7. No impact to the applicant’s credit score:

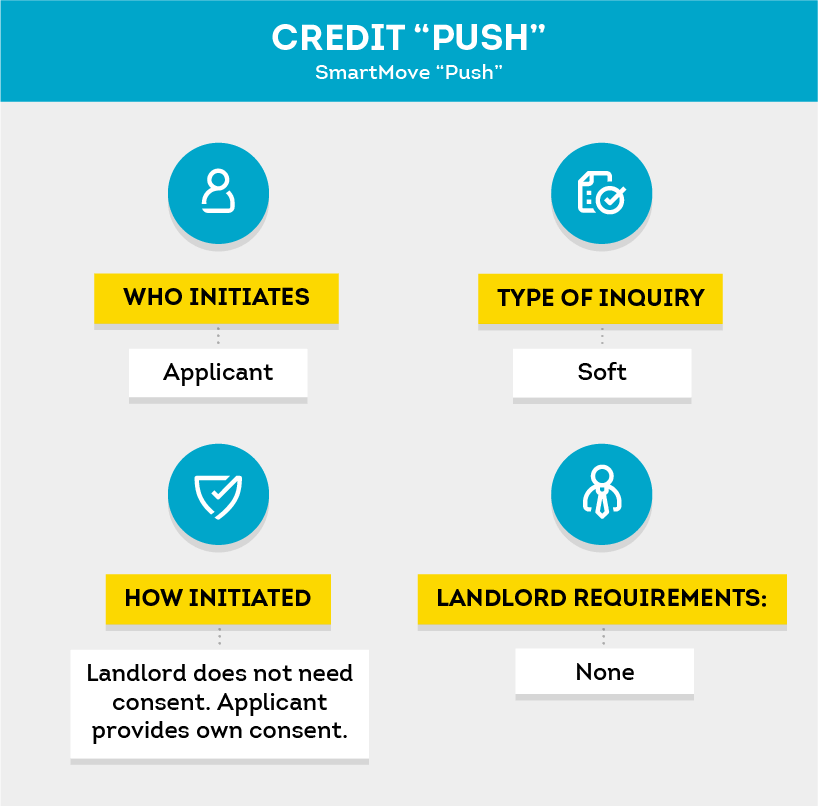

SmartMove uses a credit “push” instead of a credit “pull.” With a credit push, the renter pulls their own credit and then “pushes” it to the landlord, resulting in a soft inquiry on their credit report. A soft inquiry does not negatively impact the applicant’s credit score.

8. Built-in applicant identity verification:

SmartMove uses built-in applicant identity verification to lower the risk of fraud. When an applicant logs in to SmartMove, they answer a series of identity verification questions specifically tailored to them. With SmartMove’s patented verification process, you’ll know the reports you receive are the correct ones.

9. Manage multiple properties from one account:

Based on a 2016 TransUnion Landlord survey, the average SmartMove user owns or manages an average of three properties. SmartMove allows you to set up each rental property under your account so you can easily manage screening applications for each rental. You can even designate “leasing agents” in your account who can login and have access to review reports. This is a great option for real estate agents who’d like to give report viewing access to landlords.

10. Maintains renter’s privacy:

The applicant enters their own personal identifying information directly into SmartMove’s secure site. Therefore, landlords are relieved of the responsibility to properly store sensitive personal information, eliminating the need to go through the lengthy inspection process. Using an online tenant screening service is also ideal for renters who prefer to keep their personal information private.

11. More accurate results:

SmartMove offers enhanced subject selection on criminal and eviction reports to more accurately match results to applicants. We use our robust credit, personal, and address history database to help determine who is who. That means you receive more accurate results and less false positives.

While online tenant screening can give you great insight into an applicant’s financial and background history, your screening process should also include reference checks. You should personally check employment and personal references, and obtain recent pay stubs as proof of current income. Finally, make sure that your lease outlines all your policies and review them with the applicant to prevent possible misunderstandings down the line.

With SmartMove’s quick and reliable tenant screening service, you’ll be able to make faster and more informed decisions. A consistent process that involves pre-screening, online tenant screening, and reference checks will greatly increase your chances of finding excellent tenants, making your investment property profitable.

*Based on 2015 TransUnion data

†The SmartMove recommendation service (a credit score based recommendation) may not be available in certain jurisdictions, and is subject to laws that may limit or otherwise prohibit your use in certain jurisdictions, including but not limited to Washington D.C.